Understanding the New Compliance Landscape

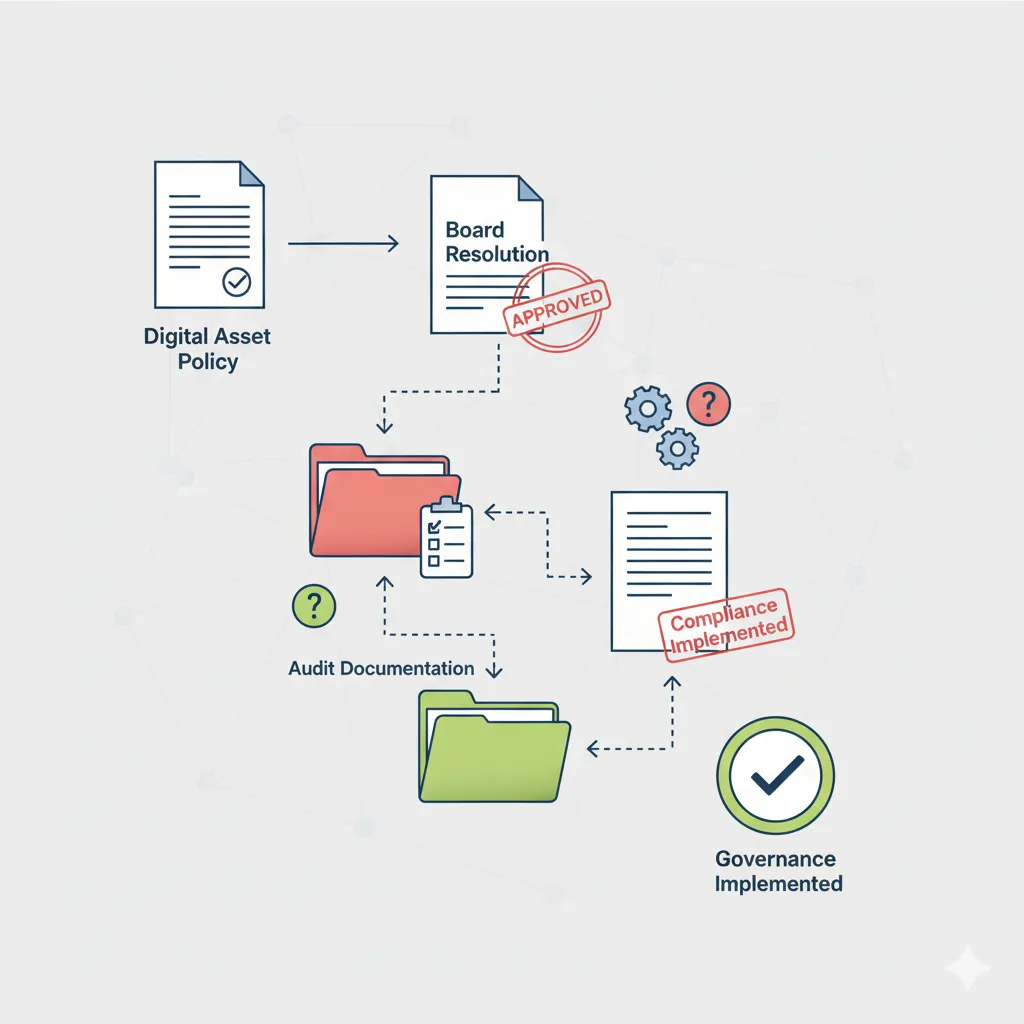

The 2025 regulatory changes fundamentally altered the crypto compliance landscape. Where previously crypto businesses could operate with informal structures and basic record-keeping, the new environment demands institutional-quality systems and documentation. Your initial assessment must identify not just current compliance status, but the client's readiness for ongoing regulatory obligations that will only increase over time.

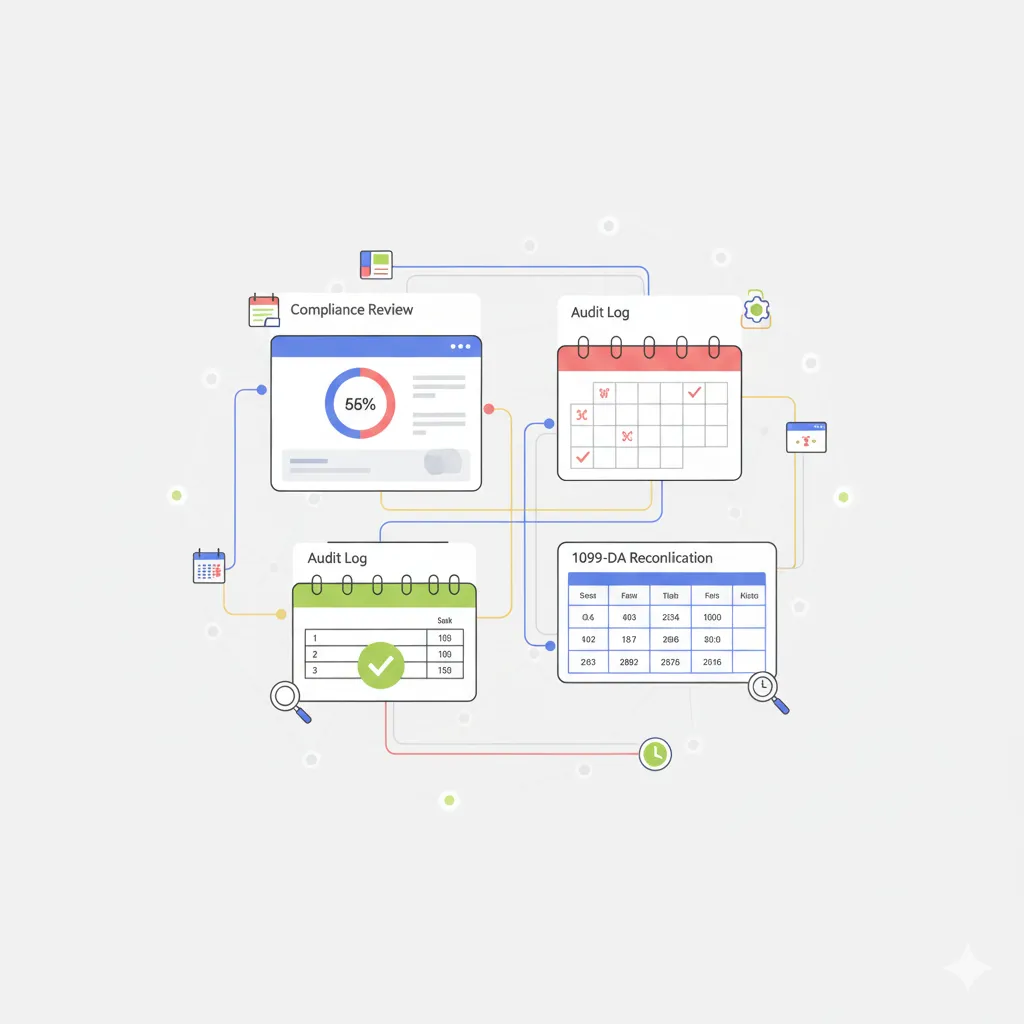

The wallet-by-wallet requirement under IRC Section 1012(c) alone creates enormous complexity for any business with multiple exchange accounts or wallet addresses. Form 1099-DA implementation means the IRS now has unprecedented visibility into crypto transactions, while CARF creates international information sharing that eliminates the possibility of geographic arbitrage for compliance avoidance.

Your onboarding process must comprehensively map the client's current situation while identifying immediate risks that require urgent attention. This isn't just about documenting what exists—it's about preparing a foundation for ongoing compliance that can adapt to future regulatory developments.

Initial Client Intake Framework

Entity Structure Documentation Checklist

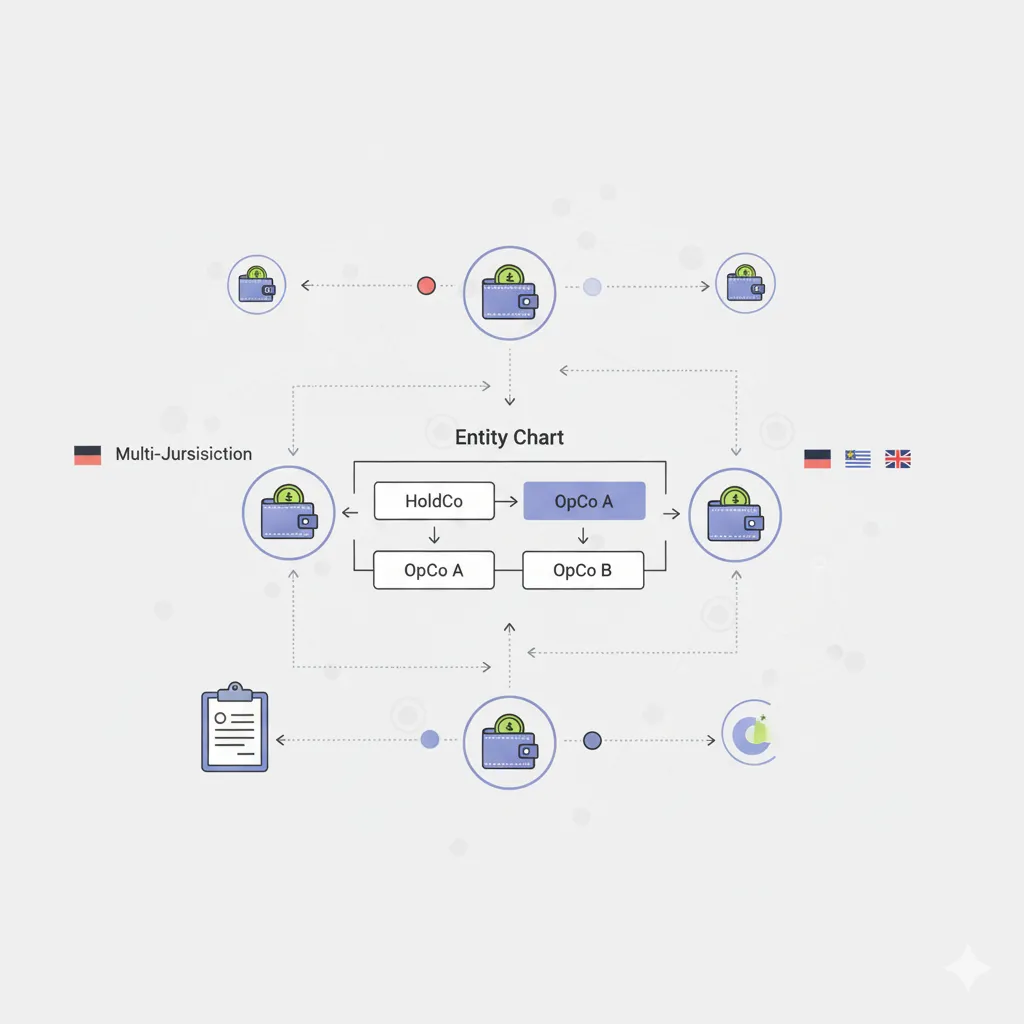

Crypto businesses often operate through complex entity structures that require careful mapping to understand compliance obligations and optimization opportunities. Document ALL entities involved:

- Parent corporation details (state, EIN, formation date)

- Subsidiary entities and ownership percentages

- Foreign entities and jurisdictions

- Partnership interests and LLC memberships

- Trust structures (if any)

- Special purpose vehicles for token holdings

- Employee benefit entities or arrangements

- Investment entities or fund structures

Many crypto businesses use multiple entities for operational, tax, or regulatory reasons. Understanding the complete structure is essential because the new regulations apply different requirements at each entity level, and optimization opportunities often involve restructuring relationships between entities.

Crypto Holdings Inventory Template

The foundation of all crypto tax compliance is a comprehensive understanding of what digital assets the client holds and how they're classified. For each digital asset holding, document:

This inventory forms the foundation for wallet-by-wallet compliance and helps identify immediate risks such as assets that haven't been properly reported or classified. Pay particular attention to custody arrangements, as they determine 1099-DA reporting obligations and potential security risks.

Strategic Assessment Questions

Your initial client meetings should follow a structured approach to uncover not just current activities, but the compliance risks and optimization opportunities that will drive your ongoing relationship:

Business Model Assessment Questions:

- "What percentage of your business revenue comes from crypto-related activities?"

This helps determine if crypto compliance is core to their business or incidental - "How many crypto transactions did you execute in the last 12 months?"

Critical for business vs. investment classification - "Do you provide services to other crypto users?"

Determines if they're subject to broker reporting requirements - "Do you hold crypto primarily for investment or operational purposes?"

Fundamental for tax classification

Current Compliance Status Questions:

- "Have you filed Form 1120 with the digital asset question answered correctly?"

Immediate compliance risk assessment - "Did you receive any 1099-DA forms for 2025?"

Cross-referencing opportunity and audit risk - "Are you using wallet-by-wallet basis tracking as of January 1, 2025?"

Fundamental compliance requirement - "Do you have employees with token-based compensation?"

Section 83 compliance obligations

International Exposure Questions:

- "Do you have entities or operations outside the United States?"

CARF and international reporting - "Do you use foreign crypto exchanges or service providers?"

FATCA and FBAR implications - "Do any foreign persons own interests in your crypto entities?"

CFC and international tax complications - "Have you filed required international forms (8938, FBAR)?"

Immediate compliance gaps

Risk Assessment and Red Flag Identification

Issues Requiring Immediate Attention:

- Still using universal pool accounting method for 2025 transactions

IRS violation requiring immediate correction - Missing or incorrect digital asset disclosure on Form 1120

False statement on federal tax return - Received 1099-DA forms but didn't report corresponding income

Automatic audit trigger - International crypto operations without proper reporting

FATCA/FBAR violations - Employee token programs without Section 83 complianceEmployment tax violations

These red flags require immediate attention because they represent current violations of federal tax law with potentially severe penalties. Your engagement timeline must prioritize addressing these issues before they compound.

High Audit Risk Indicators:

- 1,000+ transactions annually without business documentation

Likely business classification without proper structure - Large crypto holdings relative to reported income

Income recognition issues - Frequent transfers between wallets without business purpose

Potential tax avoidance schemes - Inconsistent tax treatment across multiple years

Pattern indicating poor compliance - Use of privacy coins or mixing services

Enhanced IRS scrutiny

High audit risk doesn't mean immediate violation, but it does mean the client needs robust compliance systems and documentation to defend their positions if audited.

.svg)