A Comprehensive Analysis of IRC Section 11 and Corporate Digital Asset Compliance

The 2025 tax year marked a watershed moment for corporations holding cryptocurrency and other digital assets. With the implementation of mandatory digital asset disclosure requirements on Form 1120 and enhanced IRS cross-referencing capabilities through Form 1099-DA, corporate crypto compliance has evolved from a niche specialty to a mainstream corporate governance imperative.

The Corporate Crypto Landscape – Why This Matters Now

Recent surveys indicate that over 40% of Fortune 500 companies now hold some form of digital assets, ranging from Bitcoin treasury reserves to operational cryptocurrency for business transactions. For startups and growth companies, this percentage exceeds 60%, making corporate crypto compliance a universal concern rather than an edge case.

Types of Corporate Crypto Holdings

Mandatory Form 1120 Digital Asset Disclosure

The New Corporate Question

Every corporation filing Form 1120 must now answer this question on page 1:

“At any time during the taxable year, did the corporation receive, sell, exchange, or otherwise dispose of a digital asset?”

The broad language captures virtually any corporate interaction with digital assets.

- "Receive" includes cryptocurrency payments from customers, airdropped tokens even if unsolicited, mining and staking rewards, and gifts or promotional tokens.

- "Sell, exchange, or otherwise dispose" includes direct sales for fiat currency, crypto-to-crypto exchanges, using crypto to pay business expenses, and transfers to employees as compensation.

Form 1120 Digital Asset Disclosure Impact

Compliance Strategy – Documentation Requirements

Checking "Yes" triggers several additional compliance requirements including detailed transaction reporting where corporations must maintain comprehensive records of all digital asset transactions, fair market value documentation where each transaction requires FMV determination at the time of occurrence, basis tracking with complete cost basis records using the new wallet-by-wallet methodology, and schedule attachments where large or complex transactions may require supplemental schedules.Checking "No" when the corporation had digital asset activity constitutes a false statement on a federal tax return, potentially triggering accuracy-related penalties of 20% of tax understatement, fraud penalties of 75% of tax understatement, and criminal prosecution for willful tax evasion.

IRC Section 11 Corporate Tax Rate Implications

Flat 21% Corporate Rate Application

Unlike individual taxpayers who may qualify for preferential capital gains rates (0%, 15%, or 20%), C corporations face a flat 21% tax rate on all income, including digital asset gains, under IRC Section 11.

Corporate vs Individual Tax Treatment Comparison

Strategic Implications: This rate differential creates important planning considerations for entity structure and timing strategies.

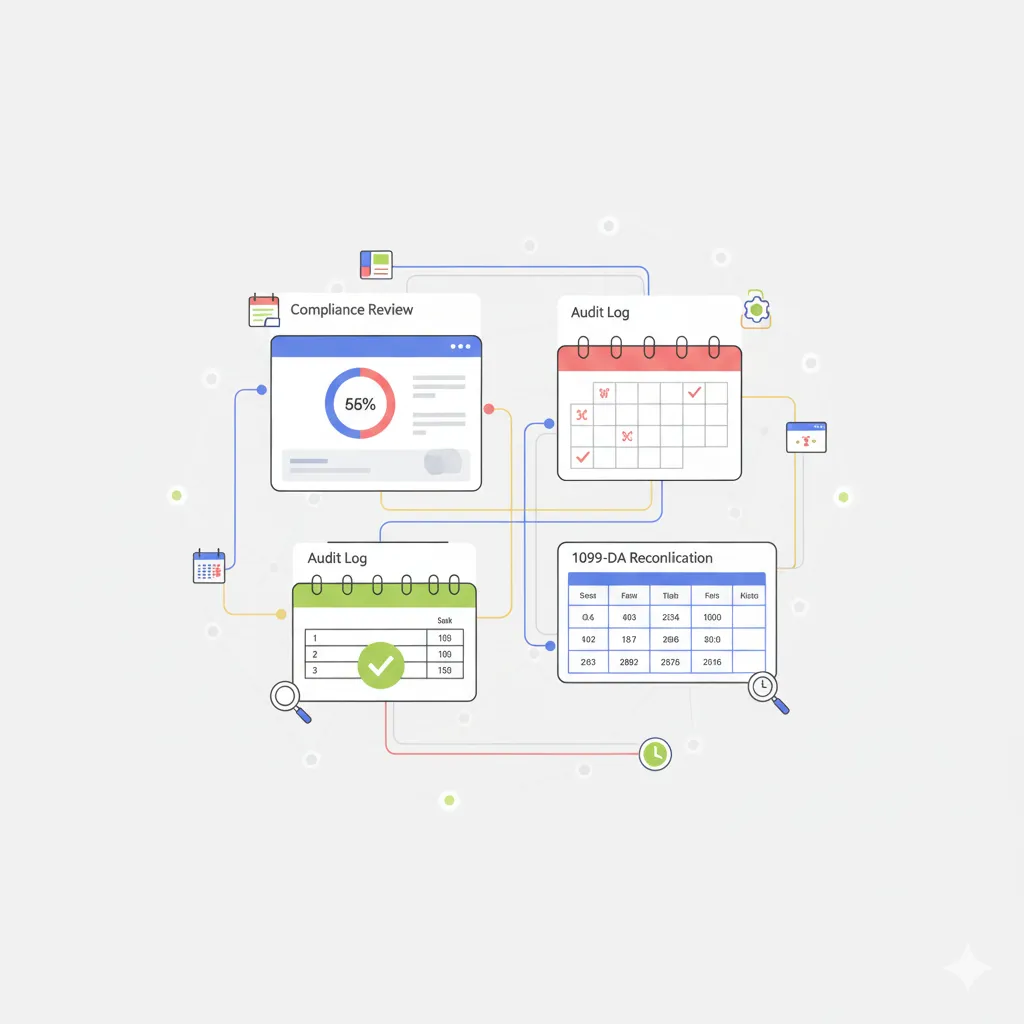

Enhanced Audit Risk and IRS Cross-Referencing

The new Form 1099-DA broker reporting system creates unprecedented IRS visibility into corporate crypto transactions through an automatic matching program. The IRS automatically cross-references 1099-DA gross proceeds reported by brokers, corporate tax return crypto activity disclosures, and blockchain analysis data from third-party providers.

IRS Automated Matching System

Wallet-by-Wallet Reporting for Corporations

Corporate Implementation Challenges

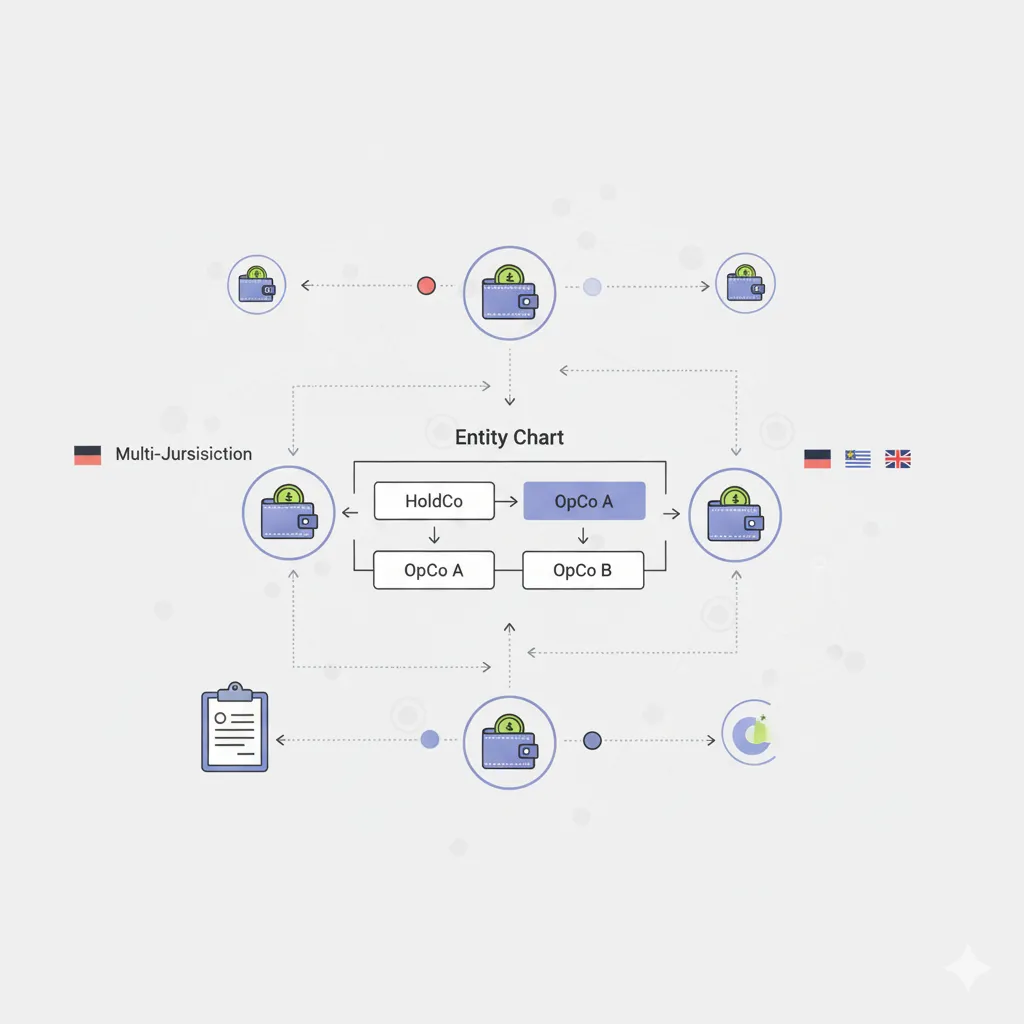

The new wallet-by-wallet requirement creates unique challenges for corporate taxpayers, particularly those with multi-entity structures. Corporations with subsidiaries must track crypto holdings separately for each legal entity. For example, a TechCorp Group structure might include TechCorp Holdings (Parent) with Bitcoin treasury reserves, TechCorp Trading (Subsidiary) for active trading operations, and TechCorp International (Foreign Sub) for international payment processing. Each entity requires separate tracking systems and independent basis calculations.

Operational vs Treasury Segregation

Best practice involves maintaining distinct wallet categories. Sophisticated corporations maintain treasury wallets for long-term Bitcoin and Ethereum reserves, operational wallets for day-to-day business transaction accounts, trading wallets for active trading and arbitrage activities, and employee compensation wallets for token-based compensation distributions.

Treasury Regulation § 1.61-2(d)(2)(i) Income Recognition

New Treasury regulations provide specific guidance on when corporations must recognize income from digital asset transactions. Immediate recognition events include receipt of cryptocurrency as payment for goods or services, mining rewards when coins are successfully mined, staking rewards when earned and accessible, and airdropped tokens when received regardless of intent to hold.

Income Recognition Events

Fair Market Value Determination

Corporate Valuation Standards

Internal Controls Framework

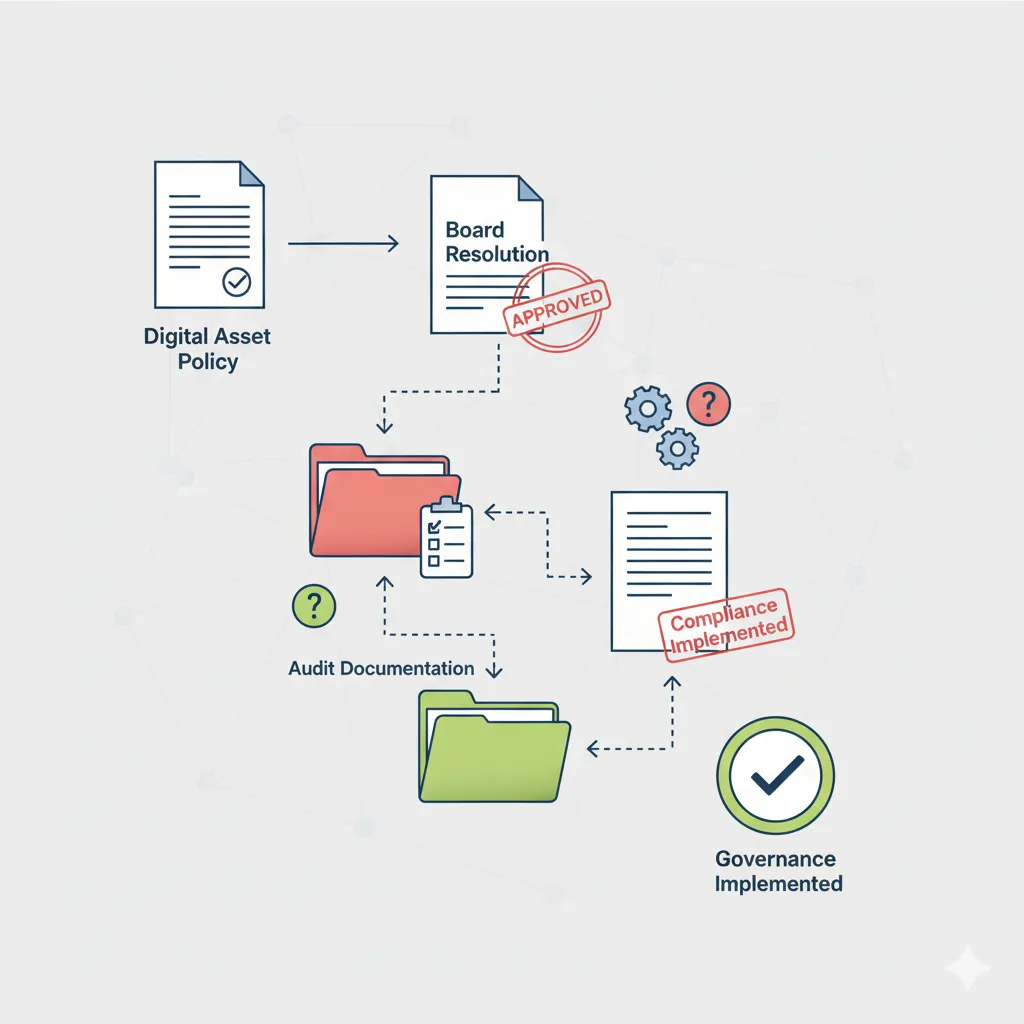

Corporate Governance Requirements

The enhanced compliance requirements necessitate board-level attention. Board resolution elements should address digital asset investment policy and risk limits, authorization procedures for crypto transactions, segregation of duties for wallet management, and regular reporting and audit requirements.

CFO responsibilities include monthly reconciliation of all crypto positions, fair market value determination procedures, tax compliance monitoring and reporting, and internal audit coordination. IT security controls require multi-signature wallet requirements for material amounts, cold storage protocols for long-term holdings, cybersecurity insurance for digital assets, and incident response procedures for security breaches.

Board Resolution Framework

Planning Strategies for Corporate Crypto Holdings

Entity Structure Optimization

Most crypto startups incorporate as Delaware C-corporations for venture capital compatibility, creating specific tax planning opportunities and challenges.

Alternative structures for crypto-focused businesses include LLC with corporate tax election, which provides operational flexibility of LLC structure, corporate tax rates without state franchise taxes, simplified international operations, and enhanced creditor protection in some jurisdictions. S Corporation considerations have limited utility for crypto businesses due to pass-through taxation complexity for crypto gains, restrictions on foreign ownership, single class of stock limitation, and built-in gains tax on conversion from C corporation.

Risk Management and Insurance Considerations

Corporate insurance requirements include custodial insurance for exchange-held assets, cold storage insurance for self-custody holdings, cyber liability insurance for security breaches, and professional liability insurance for tax compliance errors.

A risk assessment framework should include quarterly assessment of crypto holdings and market exposure, annual review of custody arrangements and security protocols, professional audit of compliance systems and procedures, and business continuity planning for crypto operations.

Future Regulatory Trends and Strategic Planning

Enhanced reporting requirements are anticipated including expanded 1099-DA reporting to include DeFi transactions, international coordination through CARF implementation, state-level crypto reporting requirements, and enhanced audit enforcement and penalty structures.

Anticipated Regulatory Developments

Conclusion

Corporate crypto compliance has become a core business function requiring board-level governance, professional-grade systems, and comprehensive documentation. The mandatory Form 1120 disclosure combined with 1099-DA cross-referencing creates unprecedented audit risk that demands institutional-quality compliance infrastructure. Corporations must treat digital asset holdings with the same rigor as traditional securities investments.

Next step: Understand how expanded broker definitions under Form 1099-DA will affect your corporate crypto transactions and service provider relationships.

.svg)