Developing Long-Term Compliance Strategy

Phase 2 moves beyond immediate compliance issues to develop comprehensive strategies that position the client for long-term success in the evolving regulatory environment. This phase requires deep analysis of the client's business objectives, risk tolerance, and growth plans to recommend structures and procedures that will scale with their operations.

The business vs. investment classification decision made during this phase will fundamentally determine the client's tax obligations and available planning strategies for years to come. Similarly, entity structure decisions made now will impact their ability to optimize taxes, attract investors, expand internationally, and implement employee compensation programs.

Your strategic planning must balance immediate compliance needs with long-term business objectives, recognizing that crypto regulation will continue to evolve and that today's structures must be flexible enough to adapt to future requirements.

Entity Structure Analysis and Optimization

Current Structure Documentation Process

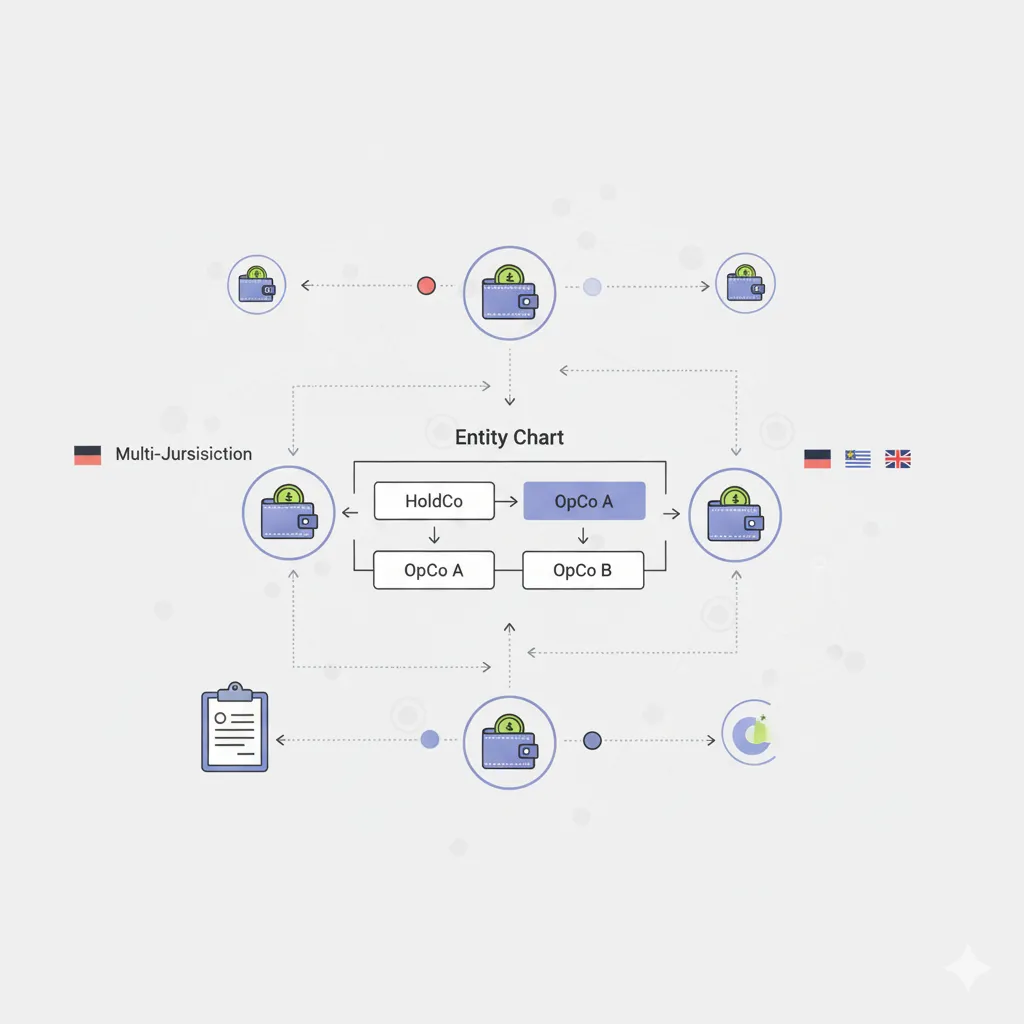

Begin by creating a comprehensive visual representation of the client's current structure. Prepare detailed org chart showing:

- All legal entities with formation dates and jurisdictions

- Ownership percentages and voting control

- Crypto asset holdings by entity with values

- Geographic locations of operations and decision-making

- Key personnel and their roles/locations

- Banking relationships and crypto exchange accounts

- Intellectual property ownership and licensing arrangements

This documentation process often reveals structural issues that create compliance problems or missed optimization opportunities. Many crypto businesses evolved organically without strategic planning, resulting in structures that made sense historically but create unnecessary complexity or risk under the new regulations.

Structure Optimization Analysis Framework

Optimization Opportunities Assessment

- No changes recommended - current structure optimal

- Create separate investment holding entity

- Establish trading subsidiary for business activities

- International restructuring for tax efficiency

- Employee compensation entity for token programs

- Consolidation of unnecessary entities

Implementation Requirements Summary

Entity structure optimization often provides significant long-term benefits, but it requires careful analysis of the costs and complexity of implementation against the projected benefits.

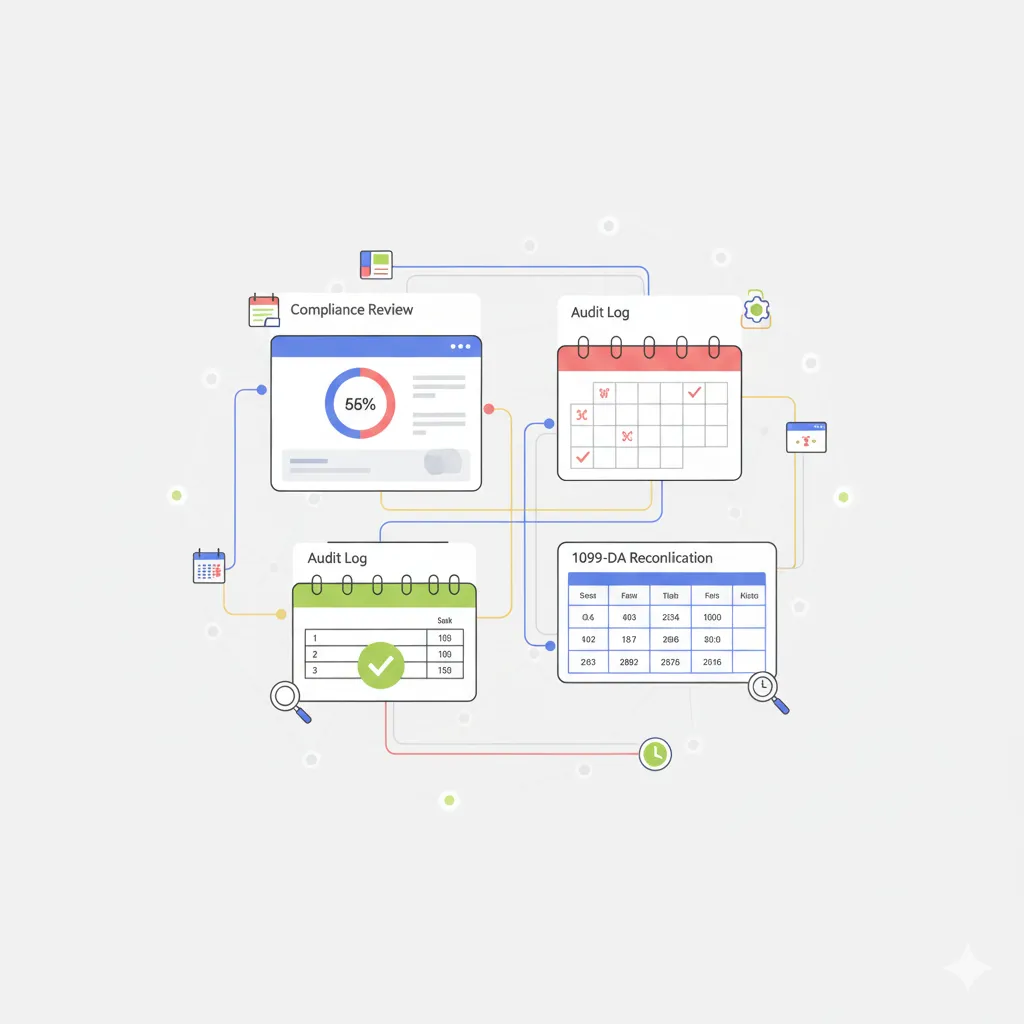

Business vs. Investment Classification Decision Framework

This decision represents one of the most critical determinations in crypto tax planning, with profound implications for tax rates, deduction opportunities, and compliance obligations. Your analysis must be thorough and well-documented because the IRS has enhanced audit capabilities that make this area a focus of enforcement attention.

Comprehensive Factor Analysis Process

Step 1: Transaction Volume and Pattern Analysis

Analysis Results:

- If >1,000 transactions: High presumption of business activity requiring substantial documentation to overcome

- If 100-1,000 transactions: Detailed factor analysis required with careful documentation

- If <100 transactions: Presumption of investment activity, but other factors may override

Step 2: Time, Effort, and Expertise Assessment

Step 3: Financial and Operational Analysis

Final Classification Recommendation: [Investment/Business]

Required Documentation and Procedures: [Detailed list]

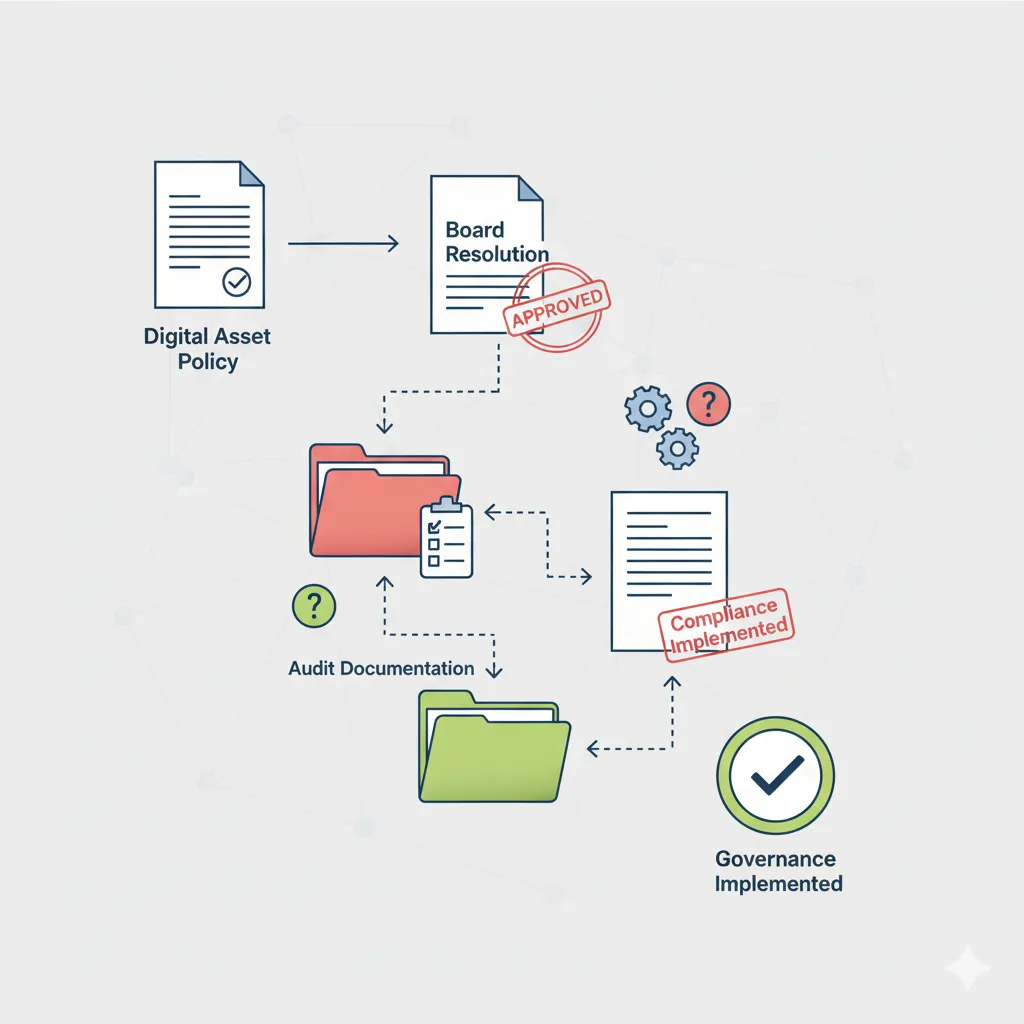

Documentation Requirements by Classification

For Investment Classification:

- Draft comprehensive investment policy statement

- Document long-term wealth building objectives

- Establish portfolio allocation limits and rebalancing procedures

- Create written procedures for investment decision-making

- Document coordination with overall financial planning

- Establish consistent holding period strategies

For Business Classification:

- Establish formal business entity structure

- Create comprehensive trading procedures and documentation

- Implement business expense tracking systems

- Establish professional operational procedures

- Document business education and expertise development

- Create systematic record-keeping and analysis procedures

The classification decision must be supported by comprehensive documentation that will withstand IRS scrutiny. This documentation becomes the foundation for all future tax compliance and audit defense.

International Compliance Assessment

For clients with international operations or connections, this phase must address the complex web of reporting obligations created by CARF implementation and enhanced international information sharing.

FATCA and FBAR Analysis Framework

Required Filings Assessment

- FinCEN Form 114 (FBAR)

- Form 8938 (FATCA)

- Form 3520 (Foreign Trust reporting)

- Form 5471 (CFC reporting)

- Other forms: [Specify]

.svg)